HDFC Tax Calculation Worksheet

To see how you real estate taxes would change under the new Regulatory Agreement proposed by HPD and UHAB/AHIFA, use our simplified tax worksheet:

1 – Look up your HDFC on the City’s website: https://tinyurl.com/HDFCtaxes

2 – Click “Agree”

3 – Enter your Borough and Building address and click “Search”

4 – On the left under “Property Info,” click “Property Tax Bills”

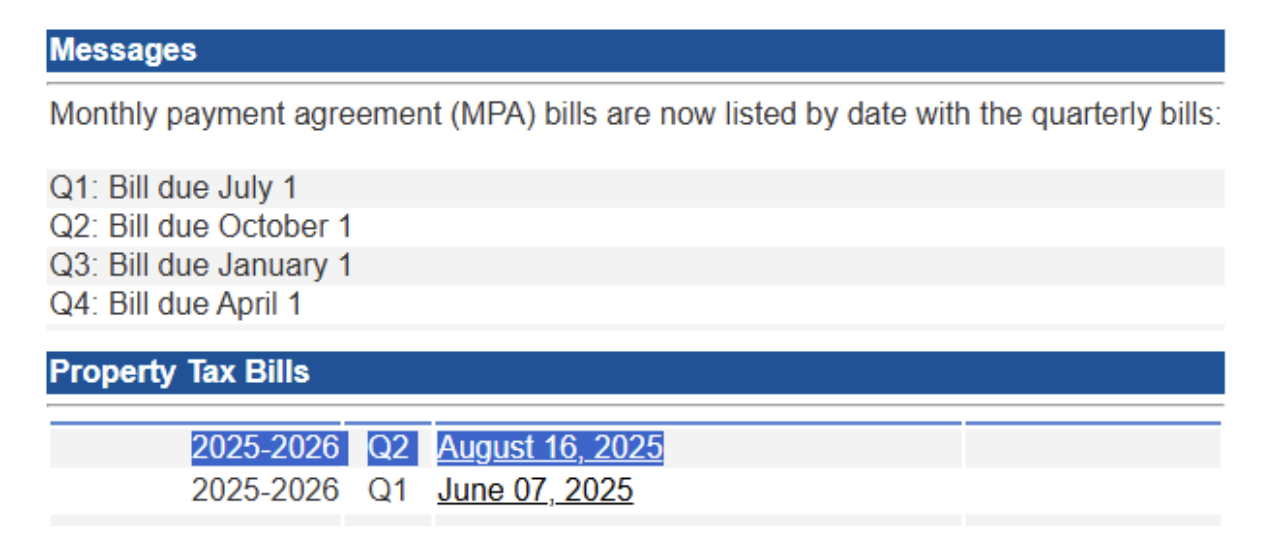

5 – In the middle of the page, click on the latest bill:

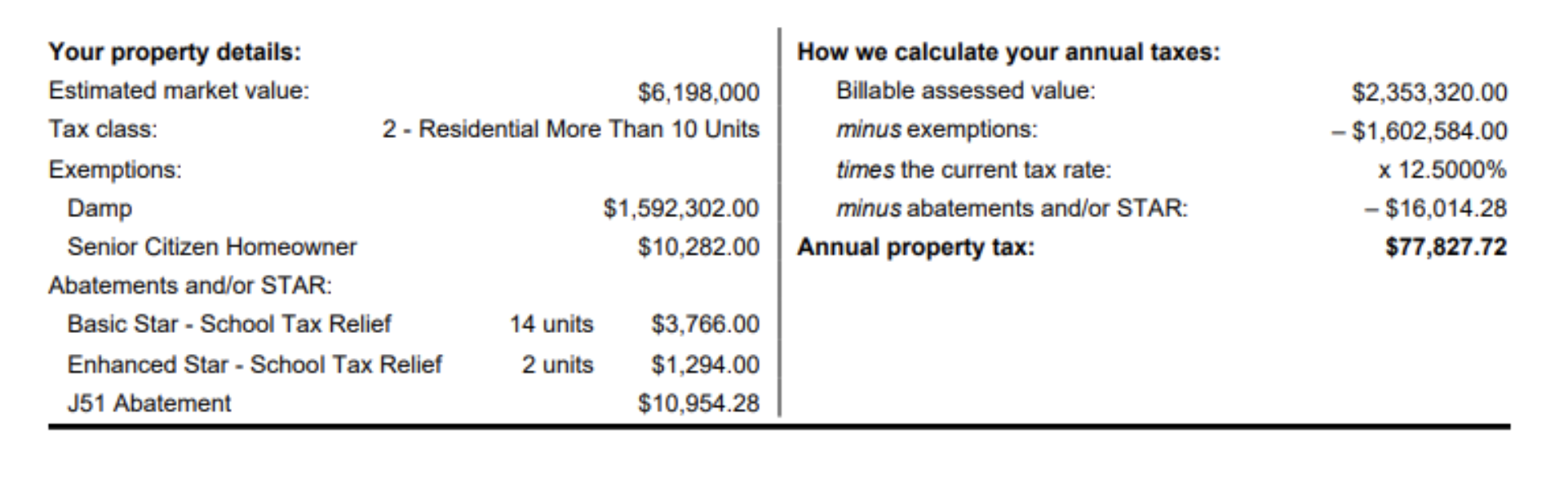

6 – When the bill opens, go to page 2 and you’ll see the following:

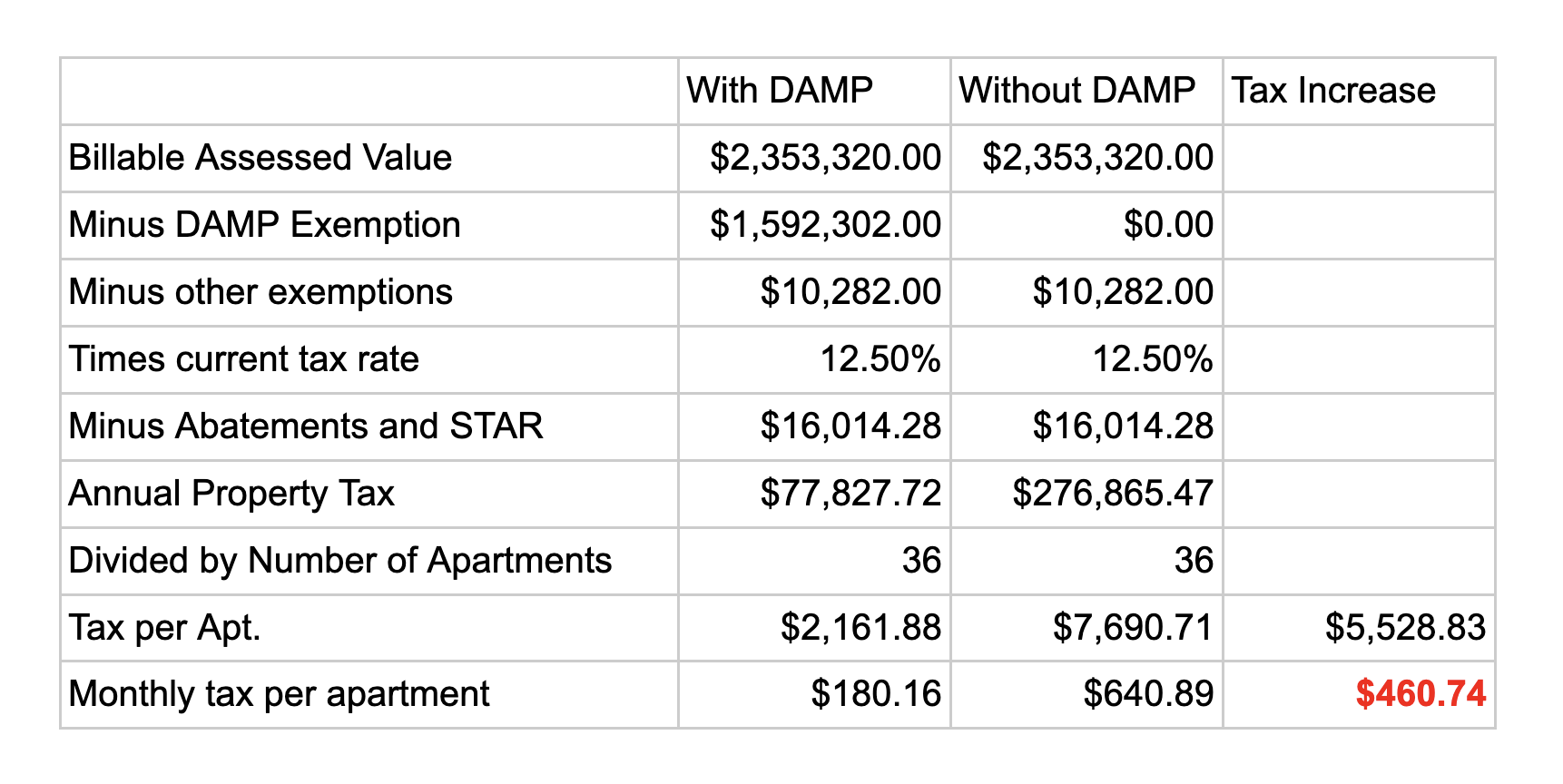

7 – To see what your taxes would be like without a DAMP exemption, remove the exemption from the column on the right, and divide by the number of units in your building to get the annual real estate taxes per apartment. Those taxes are included in your monthly maintenance bill.

8 – Here’s what happens if the DAMP tax break goes away:

The number in red on the bottom right is how much more you’ll pay in maintenance each month, just to cover your HDFC’s new tax bill.

That’s why you need to join us and fight for HDFC Justice!

This is not tax advice, and the HDFC coalition is not a tax advisor. For an estimate of the tax liability for your building, please consult a certified public accountant or a tax attorney.